Malaysian Tax Revenue Statistics

Revenue statistics in asian and pacific economies.

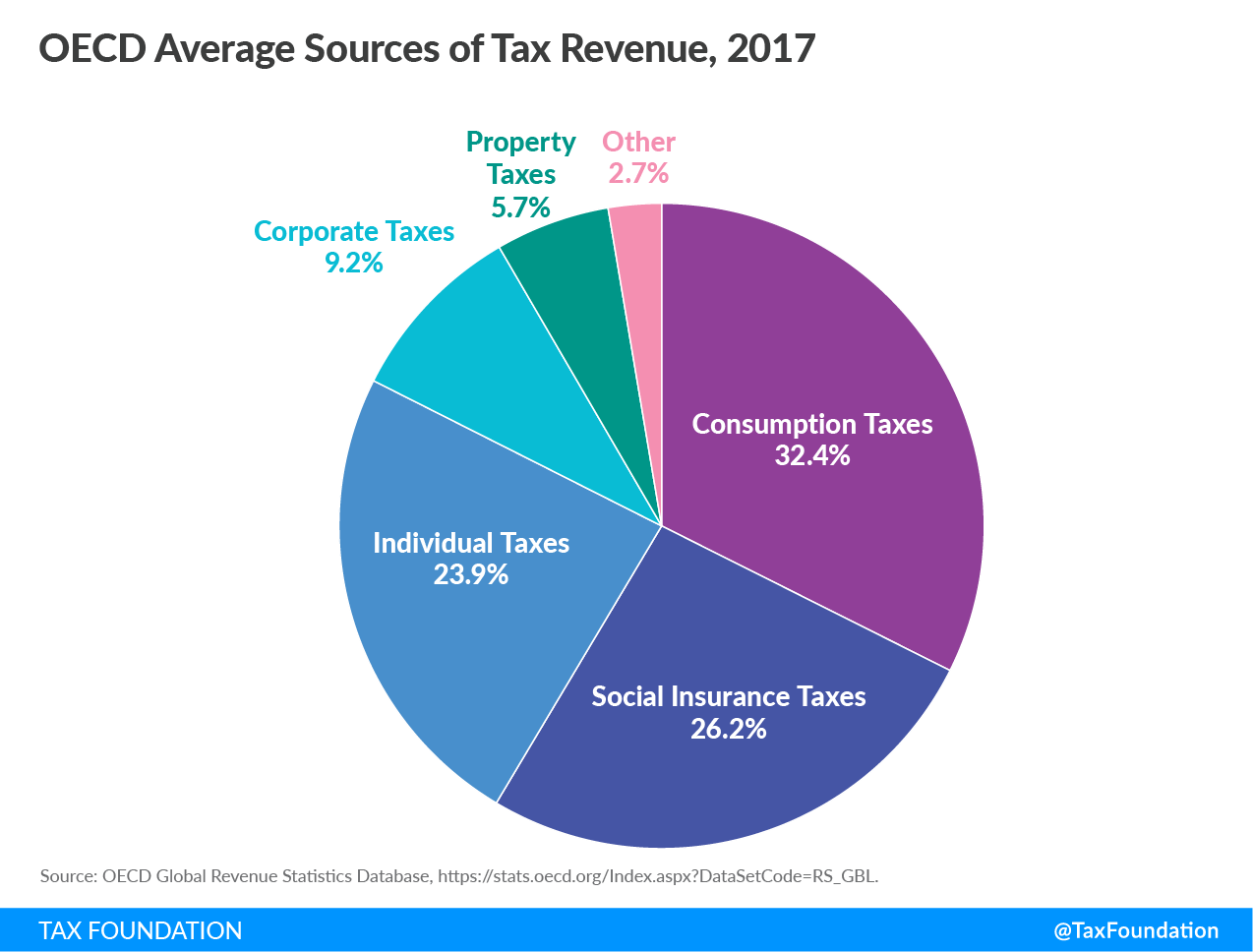

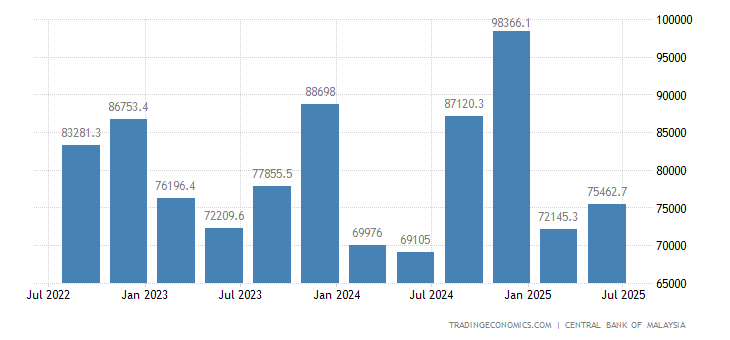

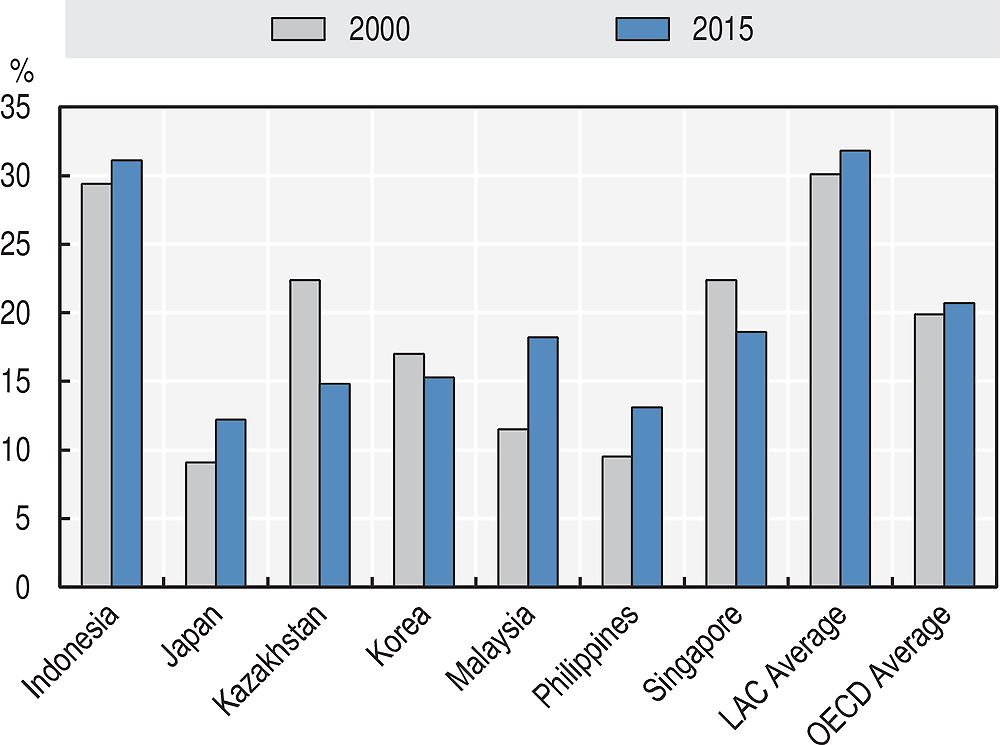

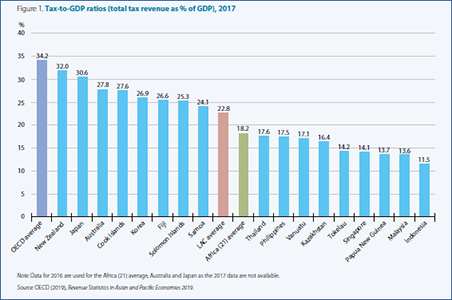

Malaysian tax revenue statistics. Key findings for malaysia. Government revenues in malaysia increased to 56449 40 myr million in the second quarter of 2020 from 45321 50 myr million in the first quarter of 2020. Malaysia s tax to gdp ratio was 12 5 in 2018 below the oecd average 34 3 by 21 8 percentage points and also below the lac and africa 26 averages 23 1 and 17 2 respectively. In 2017 the sin tax revenue from these products increased to approximately 5 86.

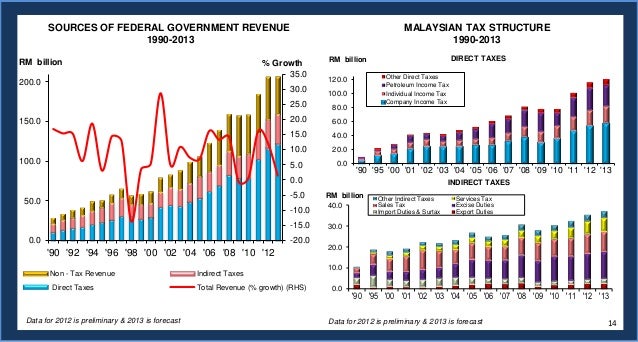

Hirschmann feb 4 2020 this statistic depicts the indirect tax revenue in malaysia from 2012 to 2018. Oe cd global rev stats database with financial support from the governments of ireland japan luxembourg norway sweden and the united kingdom malaysia s tax to gdp ratio was 12 5 in 2018 below the oecd average 34 3 by 21 8 percentage points and also below the lac and africa 26 averages 23 1 and 17 2 respectively. Government revenue in malaysia 2012 2018 published by r. That could include raising tax rates for higher income brackets and revising tax.

Revenue statistics in asian and pacific economies is jointly produced by the organisation for economic co operation and development oecd s centre for tax policy and administration ctp and the oecd development centre dev with the co operation of the asian development bank adb the pacific island tax administrators association pitaa and the pacific community spc and the financial. Government revenues in malaysia averaged 25350 16 myr million from 1981 until 2020 reaching an all time high of 69866 myr million in the fourth quarter of 2019 and a record low of 2735 myr million in the first quarter of 1982. And revenue statistics in africa. Malaysian finance minister lim guan eng is set to outline the government s spending plans for 2020 on friday.

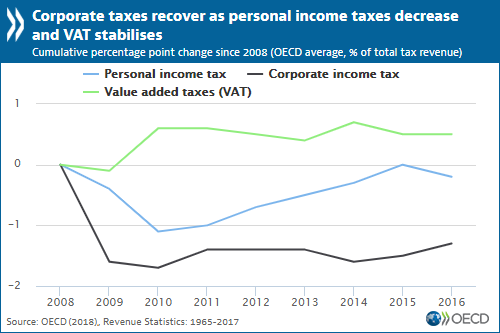

Chapter 3 table 3 15 tax revenues of subsectors of general government as of total tax revenue chapter 3 table 3 2 total tax revenue in us dollars at market exchange rate chapter 3 tables 3 7 to 3 14 taxes as of gdp and as of total tax revenue. The tax to gdp ratio in malaysia decreased by 0 9 percentage points from 13 4 in 2017 to 12 5 in 2018. In 2018 the total amount of indirect tax revenue in malaysia amounted to.