How To Declare Income Tax Malaysia 2020

Fill in your.

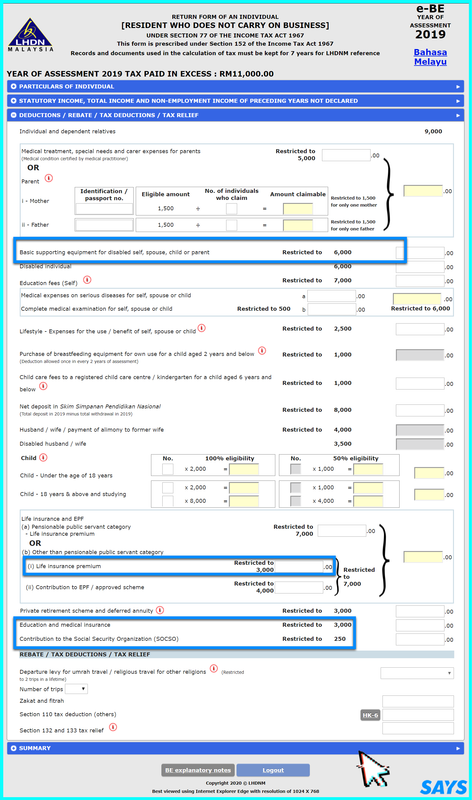

How to declare income tax malaysia 2020. Think of hefty fines up to rm20 000 imprisonment and being barred from leaving the country. In malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d rental income of the income tax act 1967. Return form rf filing programme for the year 2020 amendment 1 2020 return form rf filing programme for the year 2020 amendment 2 2020. Once you have gotten your pin here are the steps on how to file income tax in malaysia.

In fact showing healthy earnings and responsible tax payments is proof of your creditworthiness. Now let s get started and find out what s chargeable income. Meanwhile for the b form resident individuals who carry on business the deadline is 15 july for e filing and 30 june for manual filing. If you already have the pin.

These rates are optional. With this simple and easy to understand malaysia income tax guide 2020 you will be filing your tax like a whiz in no time. Login to e filing website. Imoney s income tax calculator.

Choose the right income tax form. 08 march 2019 8 mins read to find out if your rental income can be exempted from income tax first you d need to know how it s calculated. Rental income exempted from income tax malaysia and other tax reliefs for ya 2019. Depending on the age of the individual the three.

An individual who is resident in malaysia is taxable on all income accruing in or derived from malaysia and on income received from outside malaysia. Chargeability of income tax for foreigners. The lower the income the lower the tax liability and those who earn less than rs 2 5 lakh p a. Are exempt from tax.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. Existing income tax slabs for fy 2020 21 alternative the income earned individuals will determine the income tax slabs under which they fall. So it s best to be upfront about your taxes however staying out of trouble with the authorities isn t your only incentive to fully declare income. From year of assessment 2020 not applicable for 2019 2018 2017 couples seeking fertility treatment such as in vitro fertilisation ivf intrauterine insemination iui or any other fertility treatment approved by a medical practitioner registered under the malaysian medical council mmc can also claim under this income tax relief in malaysia.

For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Program memfail borang nyata bn bagi tahun 2020 pindaan 1 2020 program memfail borang nyata bn bagi tahun 2020 pindaan 2 2020 program memfail borang nyata bn bagi tahun 2020 pindaan 3 2020. Check how much income tax you ll pay with the latest tax rates here.