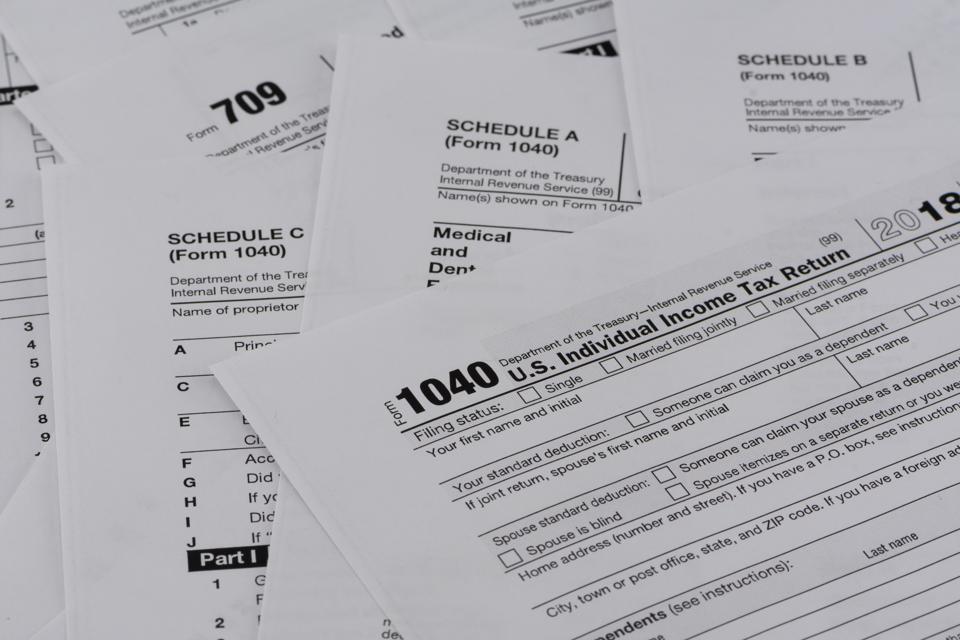

Malaysia Income Tax 2018 Deadline

On the first 5 000.

Malaysia income tax 2018 deadline. C cpe e cpe chargeable person under section 30a of the petroleum income tax act 1967 within 7 months from the date following the end of the exploration period. Filing your tax through e filing also gives you more time to file your taxes as opposed to the traditional method of filing where the deadline is usually on april 30. 10 paying income tax due accordingly may avoiding you from being charged tax increase court action and also stoppage from leaving malaysia. The government has announced an extension of two months for filing income tax from the original deadline in consideration of the movement restriction order mro that has been enforced during the covid 19 pandemic.

Kuala lumpur march 18. Original deadline revised deadline e form be e form m personal tax return with no business income i e employment income and or investment income and balance of tax payment 15 may 2020 30 june 2020 e form b e form m personal tax return with business income and balance of tax payment 15 july 2020 31 august 2020. Corporate tax rates for companies resident in malaysia is 24. On the first 5 000.

Normally the deadline for resident individuals to file their taxes is 30 april for offline channels and 15 may for filing through e filing. Home income tax rates. 1 corporate income tax 1 1 general information corporate income tax. Calculations rm rate tax rm 0 5 000.

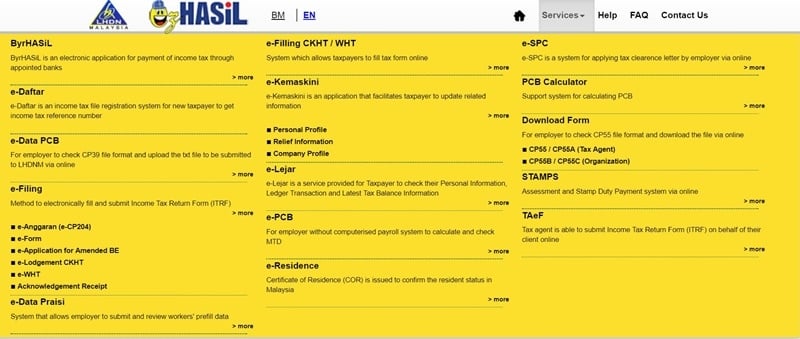

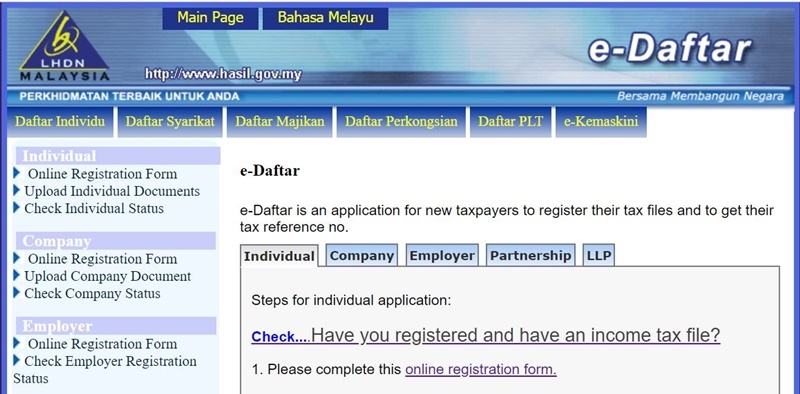

Special tax rates apply for companies resident and incorporated in malaysia with an ordinary paid up share. If this is your first time filing your tax through e filing don t worry we ve got your back with this handy guide on e filing. The inland revenue board irb has announced an extension of two months from the regular deadline for income tax filings amid the movement restriction order imposed by the government. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of.

31st august 2020 is the final date for submission of form b year assessment 2019 and the payment of income tax for individuals who earn business income. This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. The new deadline for filing income tax returns in malaysia is now 30 june 2020 for resident individuals who do not carry.

Thus taxpayers are strongly encouraged to make full use of lhdn s online service ezhasil when it comes to filing their taxes and also making any necessary tax payments. Irb extends income tax filing deadline by two months.