Non Allowable Expenses In Taxation Malaysia

Interest royalty contract payment technical fee rental of movable property payment to a non resident public entertainer or other payments made to non residents which are subject to malaysian withholding tax but where the withholding tax was not paid.

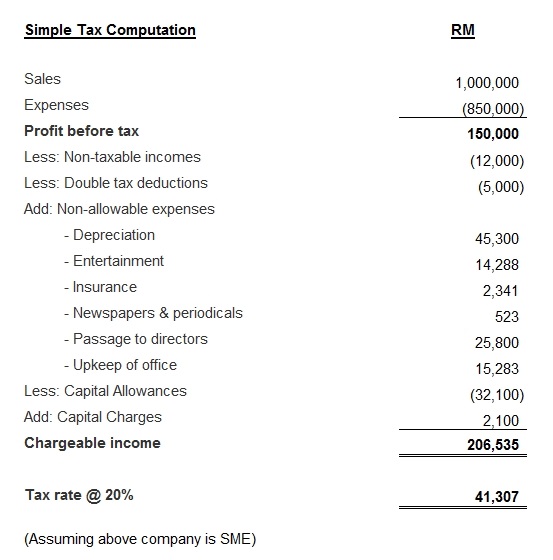

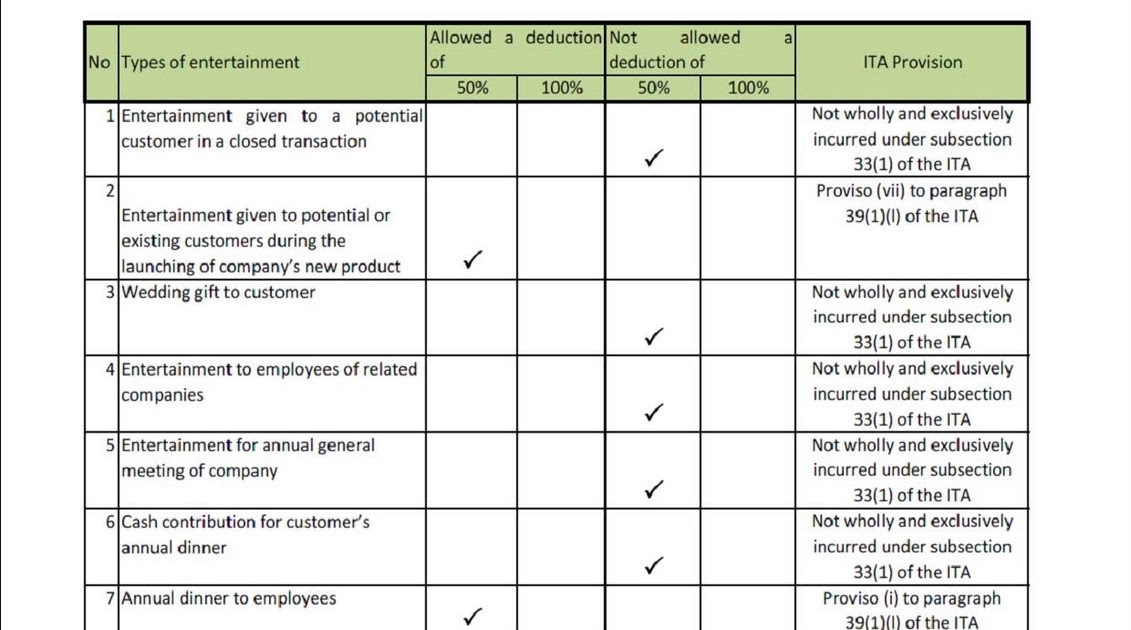

Non allowable expenses in taxation malaysia. 6 4 income tax returns a cost of filing of tax returns and tax computations. To get a copy of income tax return form from the nearest lhndm branch if the form does not reach on time. Car insurance servicing repairs the cost of clothes which could be worn. Double deduction expenses allowable under income tax act 1967.

Road fund licence for non work purposes. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. Trade professional journals general reserves for bad debts. For deductibility of interest expense in a cross border controlled transaction earnings stripping rules may apply.

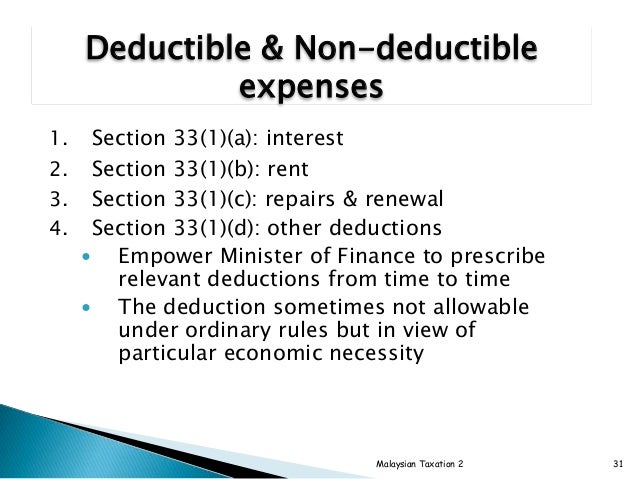

Where a borrowing is partly used to finance non business operations the proportion of interest expense will be allowed against the non business income. To the special commissioners of income tax and the courts. Tax deductions from gross income section 33 by tan thai soon section 33 1 the adjusted income of a person from a source for the basis period by deducting from the gross income of that person from that source for that period all out goings and expenses wholly and exclusively incurred during that period by that person in the production of gross income from that source including. See the group taxation section for details.

6 5 legal expense incurred by a landlord when a property is let for the first time by the owner or lessor. Legal fees and expenses non business licenses marriage driver s etc life insurance premiums unless part of an alimony payment lobbying expenses and charitable contributions used for lobbying expenses. B cost of appeal against income tax assessment i e. Postage printing legal fees and fines if you break the law.

A labuan entity can make an irrevocable election to be taxed under the income tax act 1967 in respect of its labuan business activity. Petrol diesal payments to clubs charities. There is however a longstanding practice of allowing normal recurring legal accountancy etc expenses incurred in preparing accounts or agreeing the tax liability. 2018 2019 malaysian tax booklet income tax.