Malaysian Tax Rates For Foreigners 2017

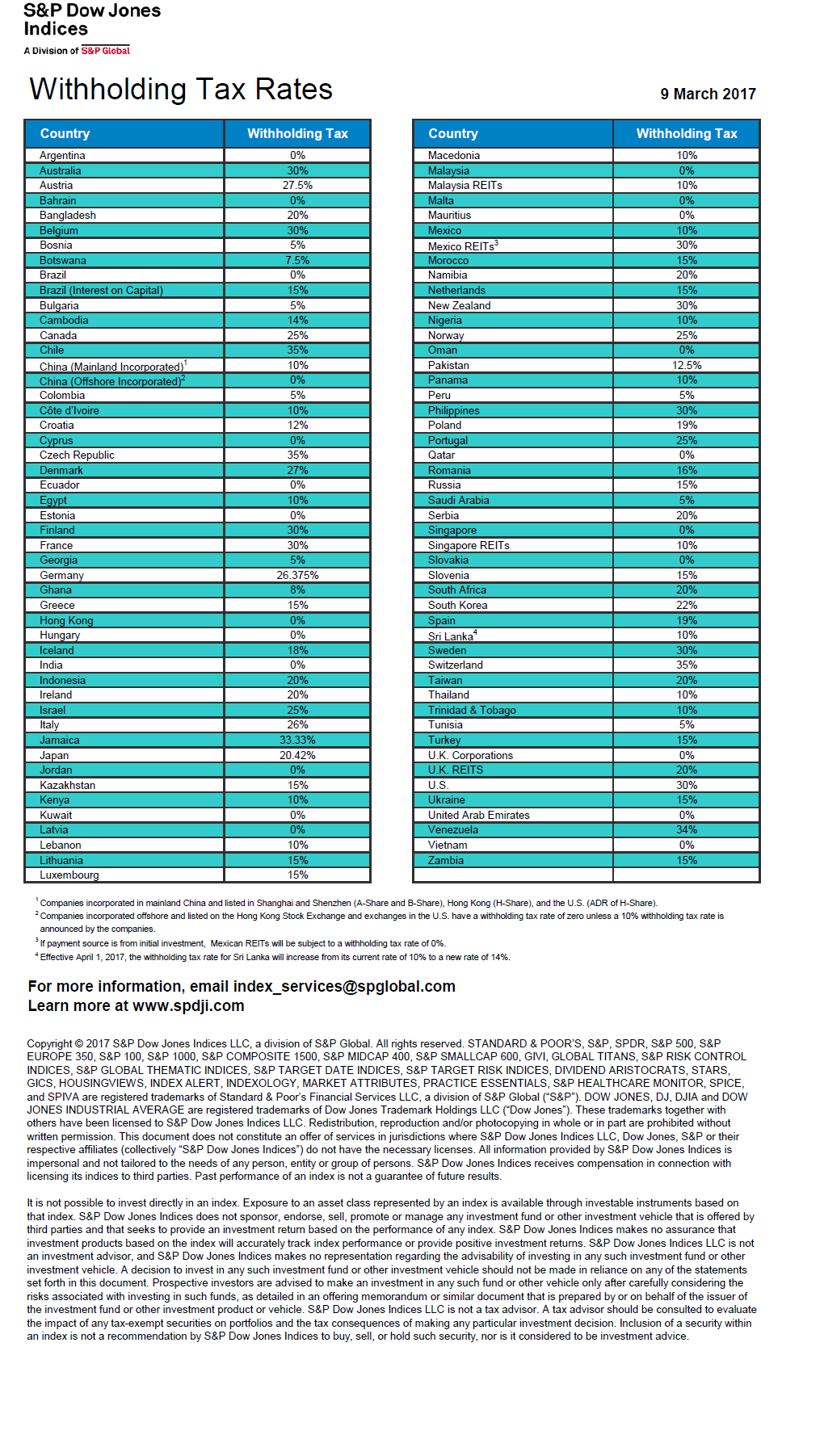

Foreigners with the non resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income.

Malaysian tax rates for foreigners 2017. As a non resident you re are also not eligible for any tax deductions. Technical or management service fees are only liable to tax if the services are rendered in malaysia while the 28 tax rate for non residents is a 3 increase from the previous year s 25. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. This page is also available in.

All tax residents subject to taxation need to file a tax return before april 30th the following year. No guide to income tax will be complete without a list of tax reliefs. The tax year in malaysia runs from january 1st to december 31st. Expatriates working in malaysia for more than 60 days but less than 182 days are considered non tax residents and are subject to a tax rate of 30 percent.

All members monthly income tax deduction for foreign workers further to the mpma circular 9 2017 dated 28 september 2017 we would like to update members on the following. However foreigners will be charged a flat rate of rm10 per night for all types of hotels and accommodation. 20 november 2017 to. Some items in bold for the above table deserve special mention.

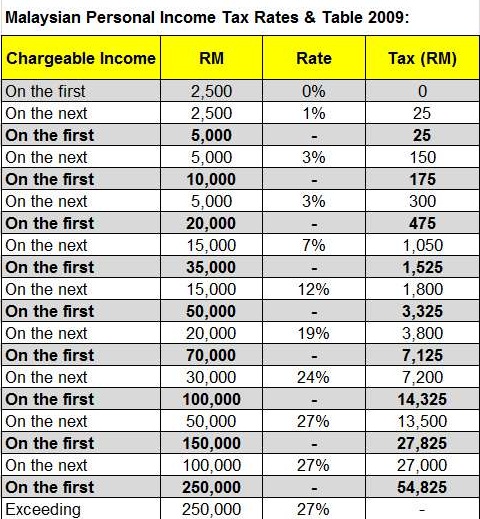

2016 2017 malaysian tax booklet a quick reference guide outlining malaysian tax information the information provided in this booklet is based on taxation laws and other legislation as well as current practices including legislative proposals and measures contained in the 2017 malaysian budget announced on 21 october 2016. Finally only income that has its source in malaysia is taxable. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Tourism and culture minister datuk seri nazri aziz has announced that malaysians are fully exempted from paying the tourism tax which will start imposing from 1st august 2017.

Failure to do so can result in a 10 increment of the payable tax or a disciplinary fee. I the use of the 2017 monthly tax deduction mtd schedule for foreign workers is. Foreign workers should seek help from registered local tax advisors to better understand their tax liabilities. Malaysia adopts a territorial principle of taxation meaning only incomes which are earned in malaysia are taxable.

Green technology educational services. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. Receiving tax exempt dividends. Melayu malay 简体中文 chinese simplified malaysia personal income tax rate.