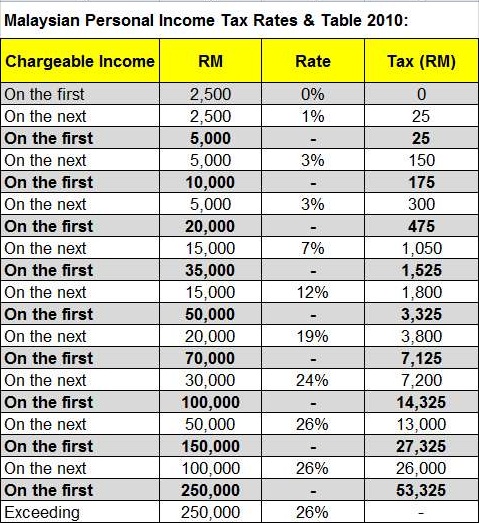

Income Tax Rate 2017 Malaysia

Assessment year 2016 2017.

Income tax rate 2017 malaysia. This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019. Income attributable to a labuan. Such qualifying persons are required to have been carrying on a business for more than two years and earned chargeable. On 10 april 2017 the income tax exemption no.

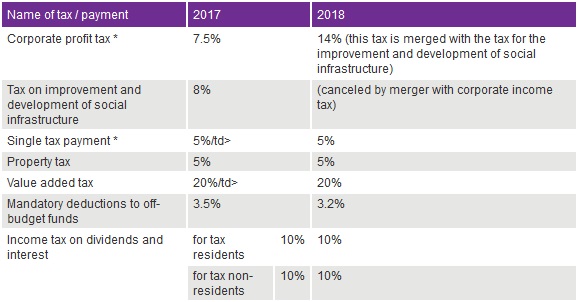

As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure. 2 order 2017 was gazetted to provide a special income tax exemption for companies limited liability partnerships trust bodies executors of estates and receivers under subsection 68 4 of the income tax act 1967 the act. No guide to income tax will be complete without a list of tax reliefs. Calculations rm rate.

First of all you need an internet banking account with the fpx participating bank. Here are the many ways you can pay for your personal income tax in malaysia. The standard corporate tax rate is 24 while the rate for resident small and medium sized companies i e. On the first 2 500.

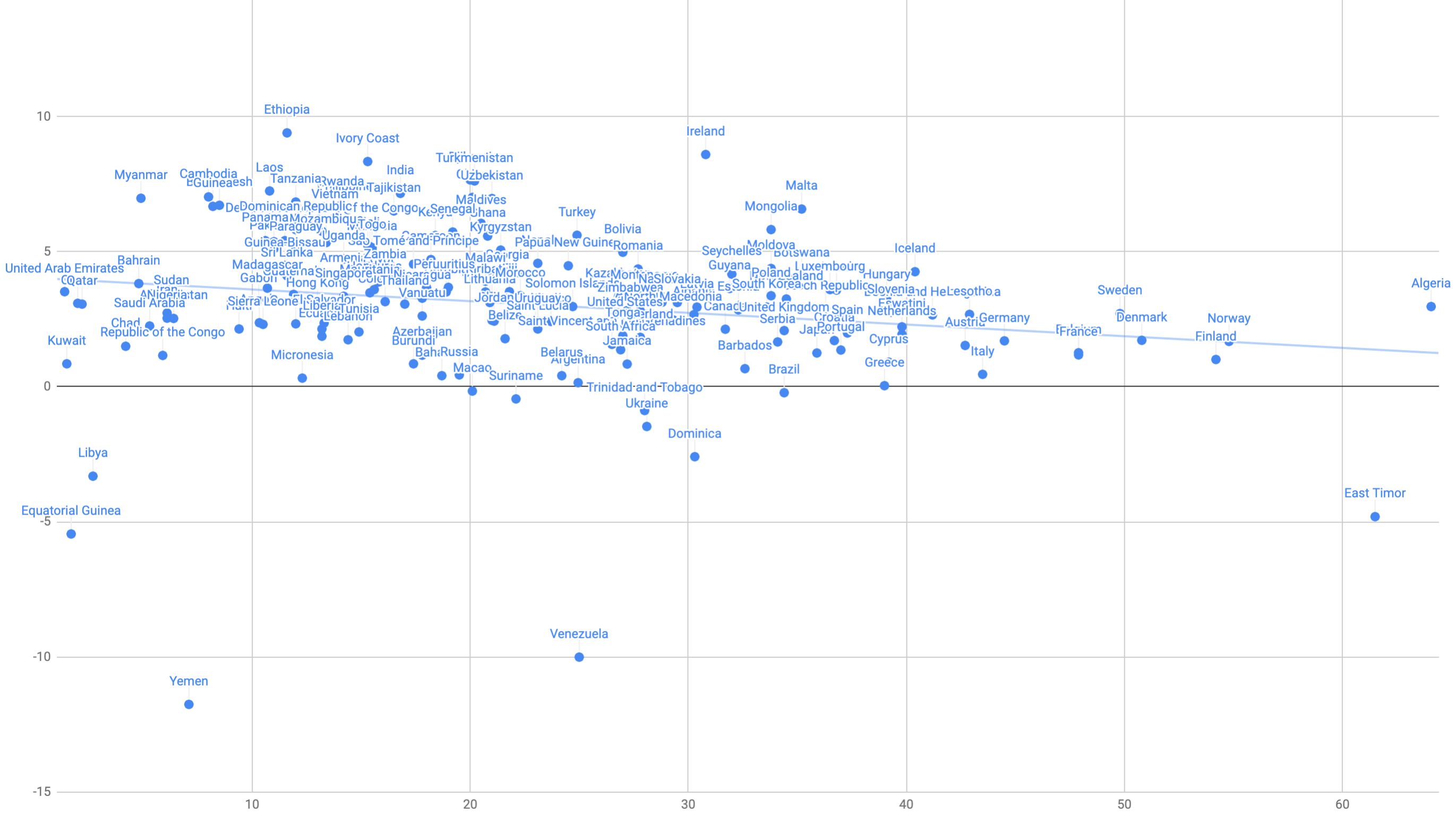

1 pay income tax via fpx services. The below reliefs are what you need to subtract from your income to determine your chargeable income. Pwc 2016 2017 malaysian tax booklet income tax scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Jadual average lending rate bank negara malaysia seksyen 140b sekatan ke atas kebolehpotongan faedah seksyen 140c akta cukai pendapatan 1967 edisi bahasa inggeris sahaja study group on asian tax administration and research sgatar.

The fpx financial process exchange gateway allows you to pay your income tax online in malaysia. Companies incorporated in malaysia with paid up capital of myr 2 5 million or less and that are not part of a group containing a company exceeding this capitalization threshold is 18 on the first myr 500 000 with effect from year of assessment ya 2017 with the balance being taxed at the 24 rate. While the 28 tax rate for non residents is a 3 increase from the previous year s 25. Malaysia personal income tax rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a max of 28.