Income Tax In Malaysia For Foreigners 2019

References income tax act 1967.

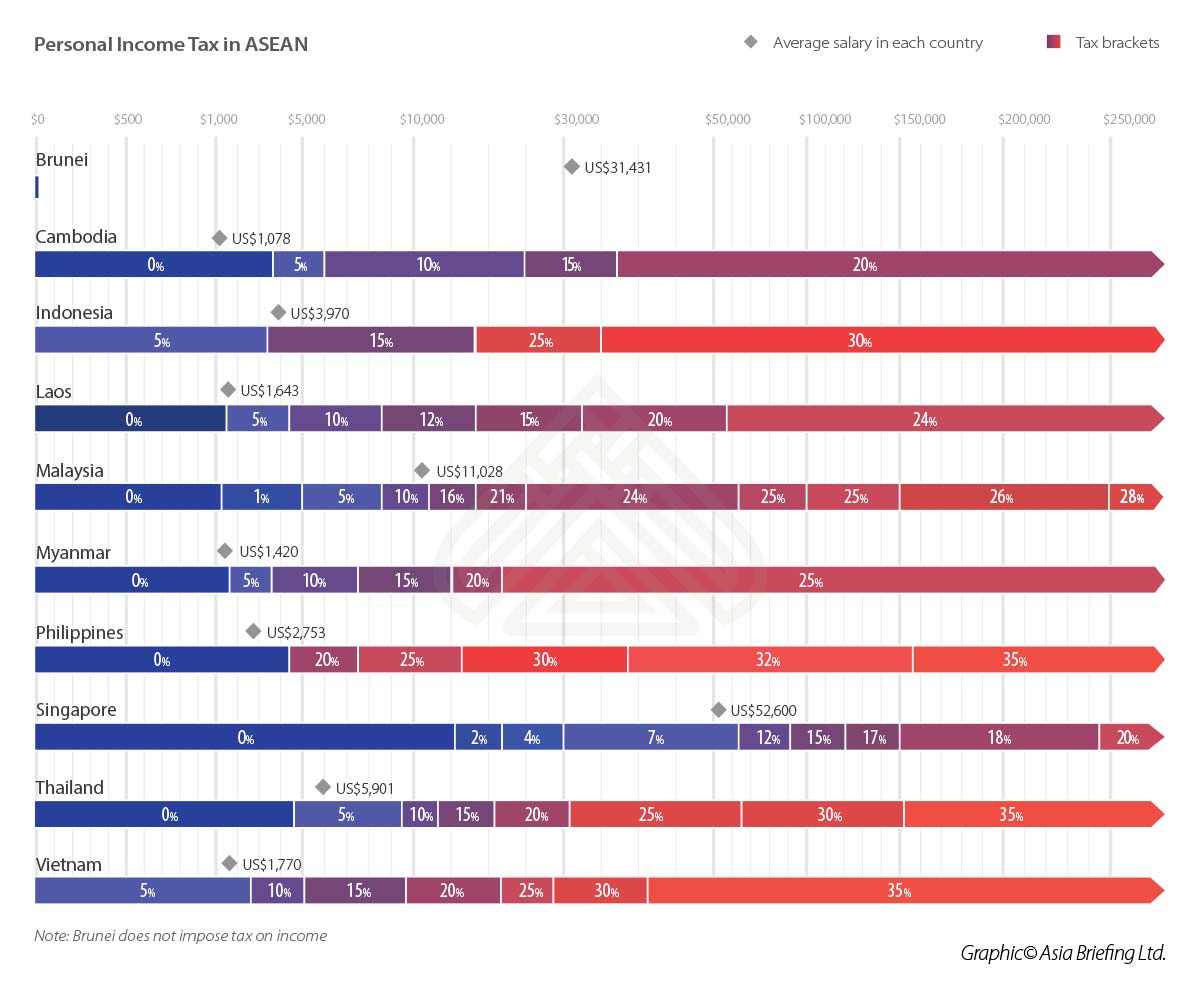

Income tax in malaysia for foreigners 2019. There are many tax exemptions in malaysia which is why the country is quite attractive from this point of view to foreign investors and here we remind the following. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income. Understanding tax rates and chargeable income here are the income tax rates for personal income tax in malaysia for ya 2019. If taxable you are required to fill in m form.

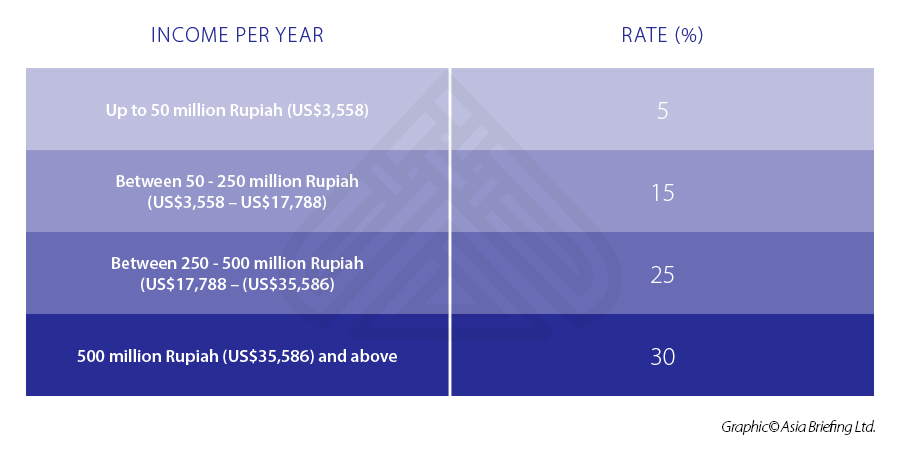

On the first 5 000. In malaysia the companies are levied on incomes and the tax rate is settled at 25. For expatriates that qualify for tax residency malaysia has a progressive personal income tax system in which the tax rate increases as an individual s income increases starting at 0 percent and capped at 30 percent. Calculations rm rate tax rm 0 5 000.

Income tax deadline extended until 30 june 2020. Malaysia adopts a territorial approach to income tax. Tax relief and deductions. The deadline for filing income tax in malaysia is 30 april 2019 for manual filing and 15 may 2019 via e filing.

May 25 2019 foreign sourced income is not subject to tax in malaysia except for certain activities such as banking insurance and air and sea transport operations. The applicable tax rates are the following. You can file your taxes on ezhasil on the lhdn website. On the first 5 000 next 15 000.

As for the technical fees royalties and other earnings we remind that the tax rate is 10. In lieu with the movement control order period from 18 to 31 march 2020 due to covid 19 pandemic irb has extended the income tax deadline for this year. As a non resident you re are also not eligible for any tax deductions. With effect from ya 2004 foreign source income derived from sources outside malaysia and received in malaysia by any person other than a resident company carrying on the business of banking insurance or sea or air transport is not.

Foreign source income refers to income which is accrued in or derived from a tax jurisdiction outside malaysia. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8. Foreigners with the non resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income.