Income Tax Act 1967 Schedule 1

An act to impose a tax upon incomes.

Income tax act 1967 schedule 1. 2 interpretation 1 in this act affiliate in relation to a petroleum operator has the meaning given by subsection 4 of section thirty two. Income tax act 1967. Rates of tax schedule 1 section 6 rates of tax part i 1. Income tax act 95 of 1967 income tax act 76 of 1968 income tax act 89 of 1969 income tax act 52 of 1970 income tax act 88 of 1971.

This act may be cited as the income tax act 1967. Act 53 income tax act 1967 arrangement of sections part i preliminary section 1. 1 short title this act may be cited as the income tax act chapter 23 06. Machinery for assessment charge and payment of tax under schedule c and in certain cases schedule d.

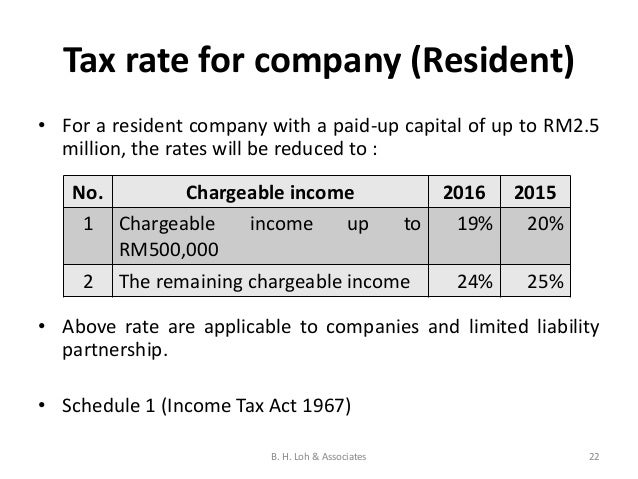

Agent includes a any partnership or company or any other body of persons corporate or unincorporate when. Chargeable income rm rate of income tax. Charge of income tax 3 a. An act to consolidate enactments relating to income tax and sur tax including certain enactments relating also to corporation profits.

Short title and commencement 2. Classes of income on which tax. Income tax act 1967. Sections 48 460 461.

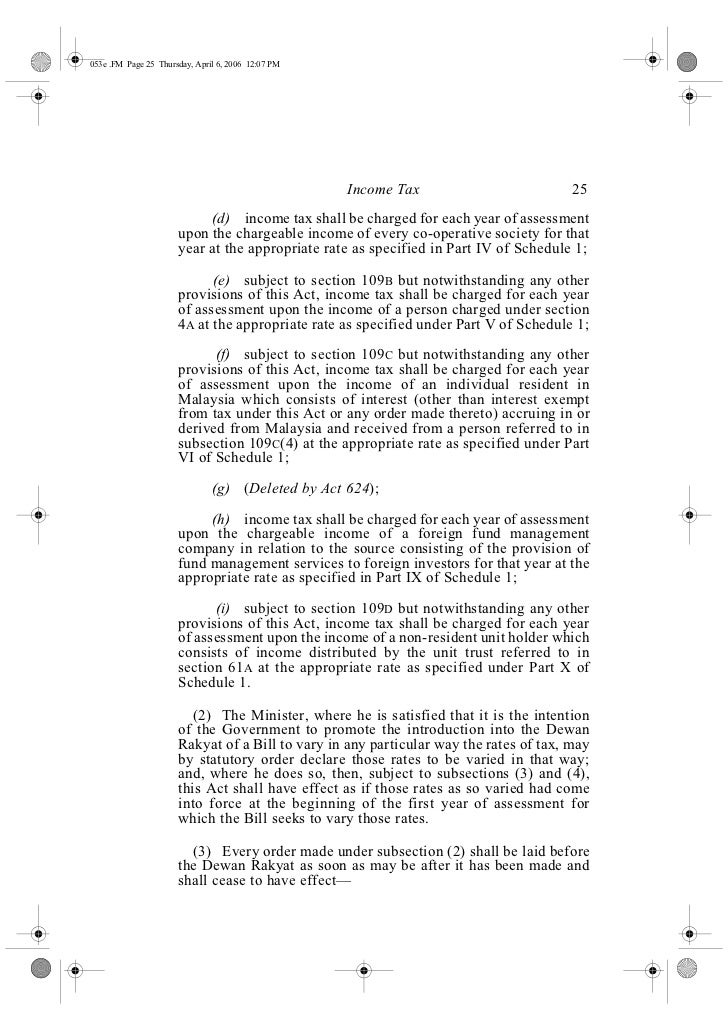

Except where paragraphs 1 a 2 2a and 3 provide otherwise income tax shall be charged for a year of assessment upon the chargeable income of every person at the following rates. Interpretation part ii imposition and general characteristics of the tax 3. Non chargeability to tax in respect of offshore business activity 3 c. Public revenue dividends etc payable to the bank of ireland or entrusted for payment to the bank of ireland.