Import Duty Malaysia 2019

100 horses 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 200 asses mules and hinnies 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0.

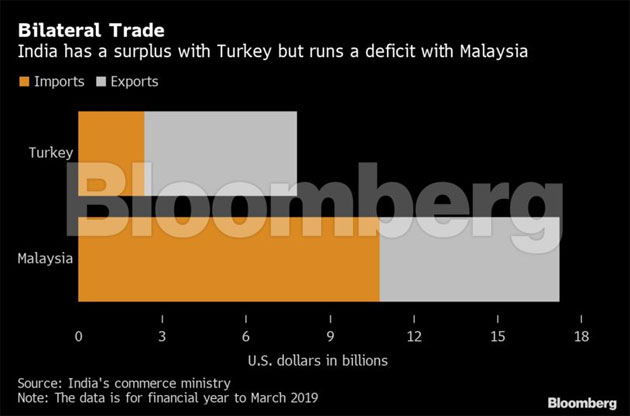

Import duty malaysia 2019. 10 pure bred breeding animals. Trying to get tariff data. Malaysia s tariff schedule under the malaysia india comprehensive economic cooperation agreement miceca hs code chapter 1 live animals. Register login gst shall be levied and charged on the taxable supply of.

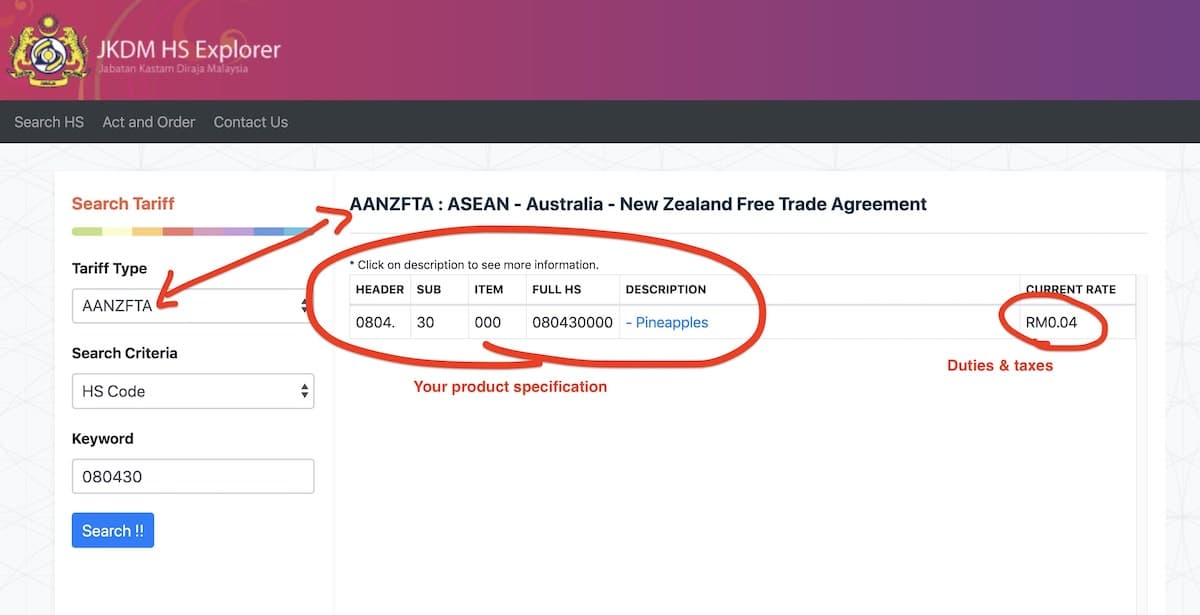

Gst calculator gst shall be levied and charged on the. Prescribed drugs can only be imported into or exported from the country by virtue of a licence issued by the ministry of health malaysia. Tariff schedule of malaysia tariff schedules and appendices are subject to legal review transposition and verification by the parties. It s fast and free to try and covers over 100 destinations worldwide.

Check with expert gst shall be levied and charged on the taxable supply of goods and services. Complaint suggestion public complaint system. Required to calculate import duties taxes. Event calendar check out what s happening.

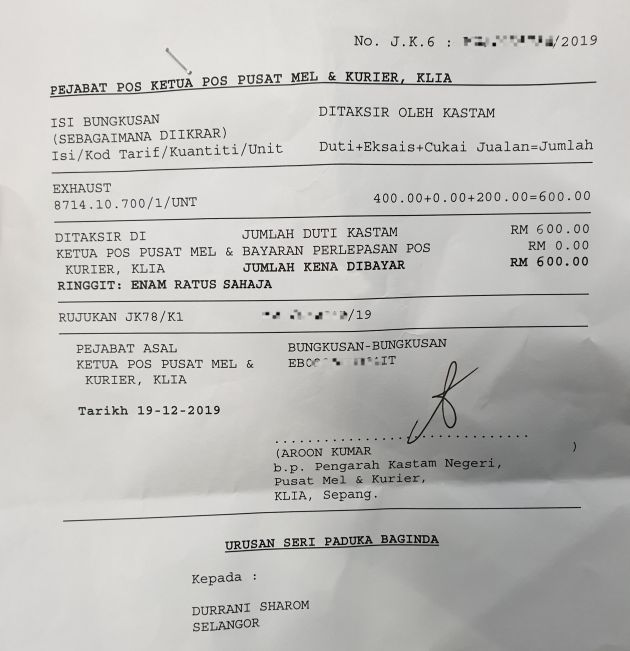

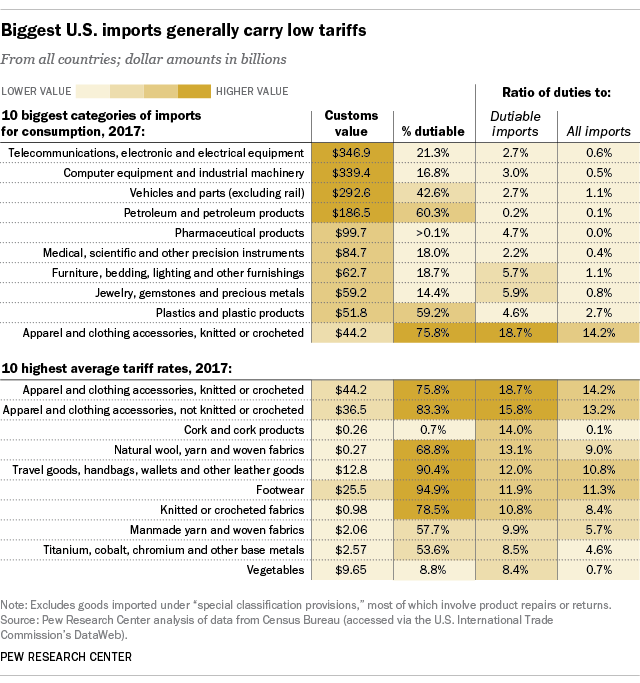

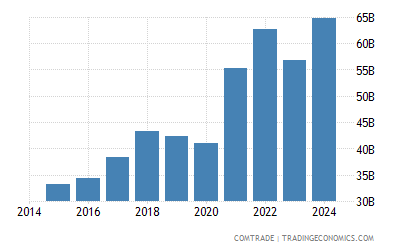

Duty paid and released from customs control. Malaysia s tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 6 1 percent for industrial goods. Manufacturers who manufacture taxable goods with sales value which exceeds rm500 000 within the period of 12 months are required to be registered pursuant to section 12 sales tax act 2018. In addition effective 1 july 2019 specified sweetened beverages are subject to an excise duty rate of rm 0 40 per litre.

Required to calculate import duties taxes. Import and export of illicit drugs eg. What is the name of your logistics company. Malaysia import duty calculator please complete information below exporting from which country.

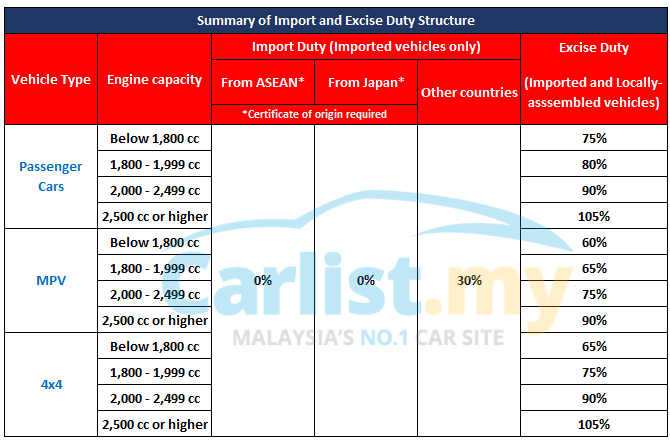

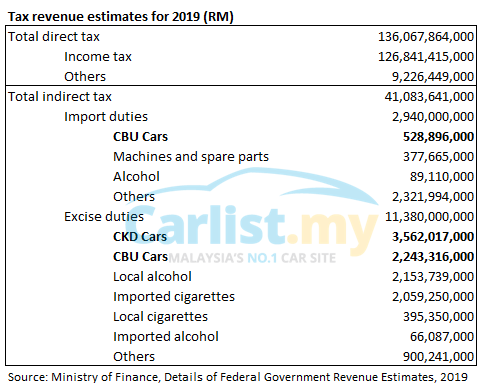

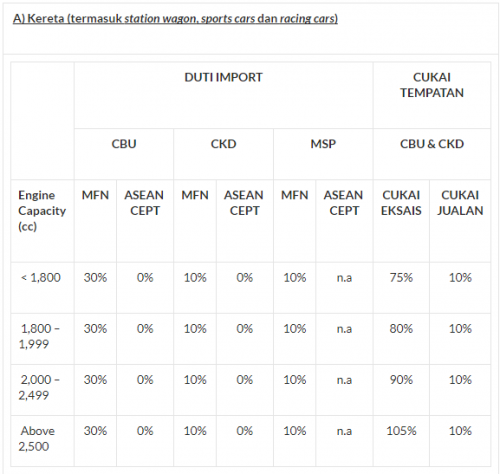

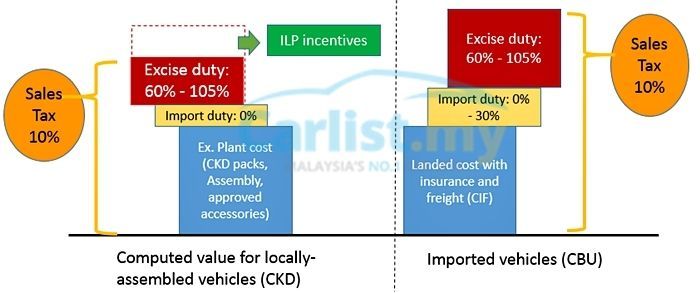

Agency browse other government agencies and ngos websites from the list. The rates of excise duties vary from a composite rate of 10 cents per litre and 15 for certain types of spirituous beverages to as much as 105 for motorcars depending on engine capacity. Morphine heroine candu marijuana etc are strictly prohibited. The only authentic tariff commitments are those that are set out in the tariff elimination annex that accompanies the final signed agreement.

For certain goods such as alcohol wine poultry and pork malaysia charges specific duties that represent extremely high effective tariff rates. Hak cipta terpelihara 2018 jabatan kastam diraja malaysia. Importing to which country.