How To Pay Income Tax Online In India

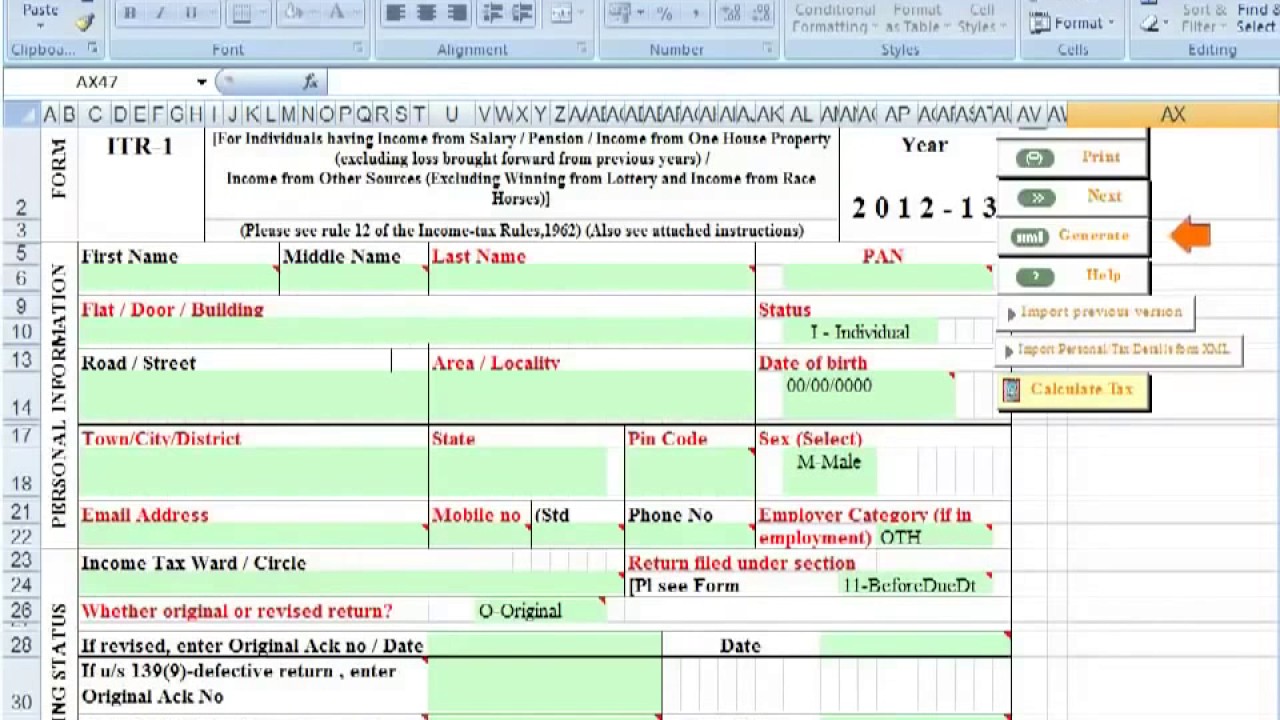

Pay tax online step 1.

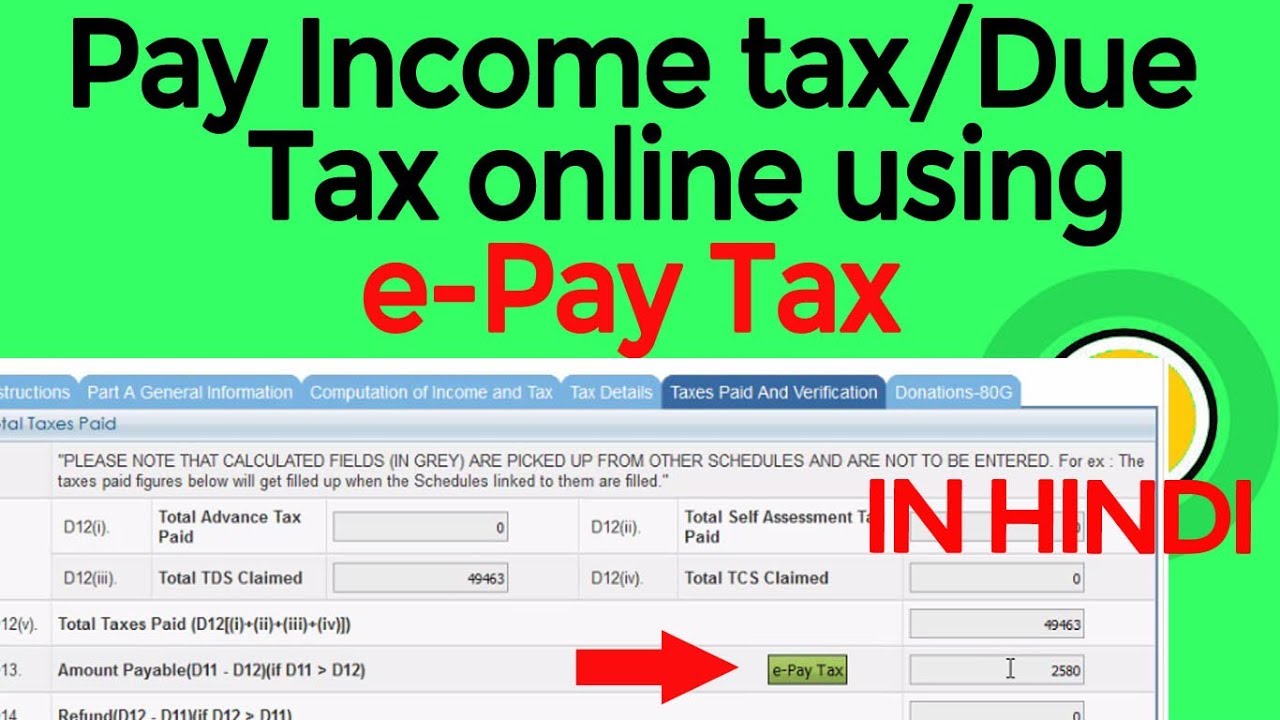

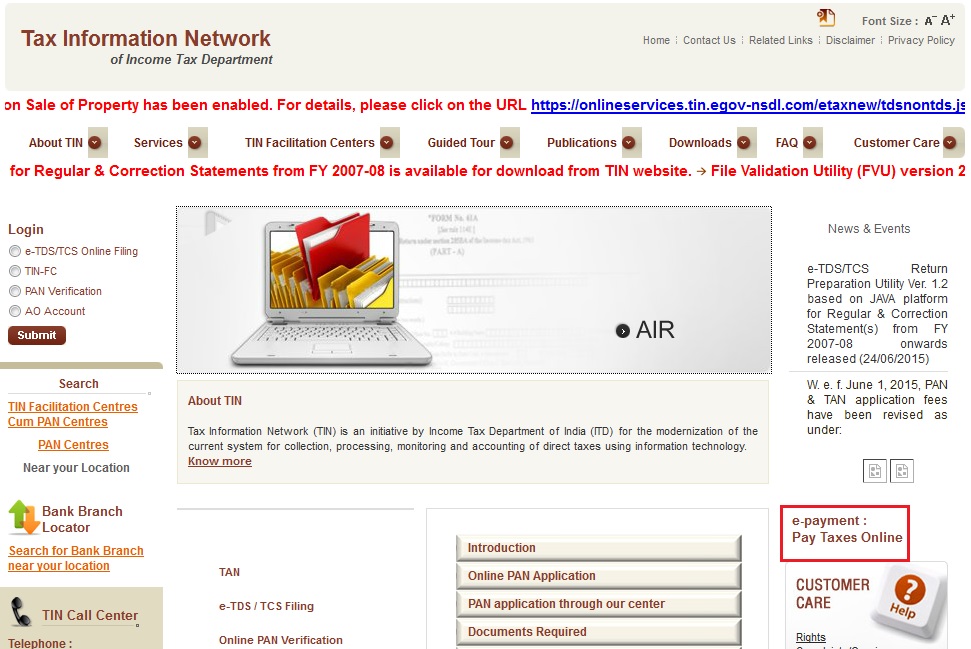

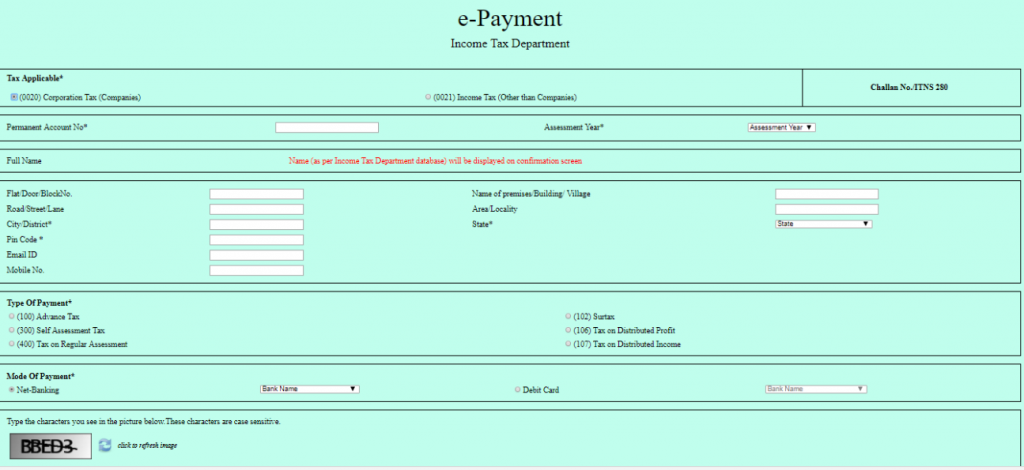

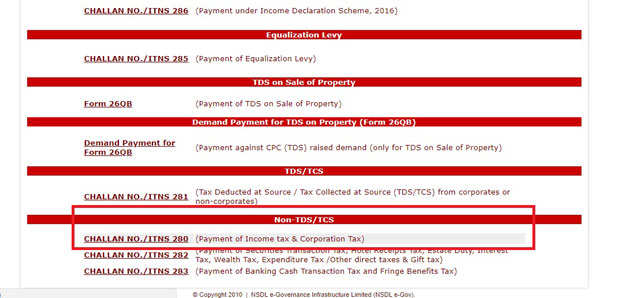

How to pay income tax online in india. Select option retail user in the bank s internet banking website while logging 8. On that page under the last option non tds tcs select challan no. Income tax payments can be done online by a person who is having net banking facilities in any approved bank like hdfc sbi and icici etc. Pay taxes online or click here on.

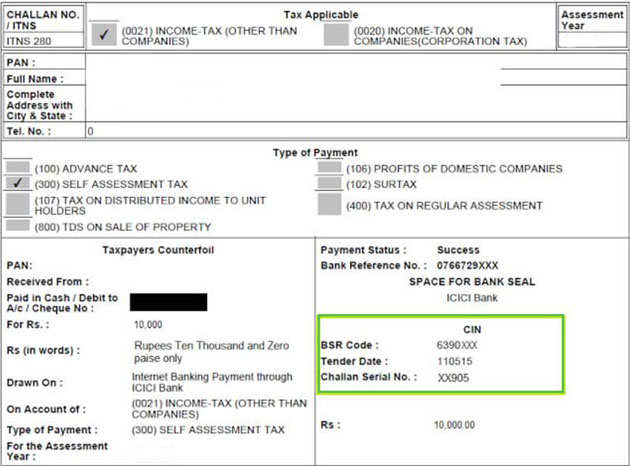

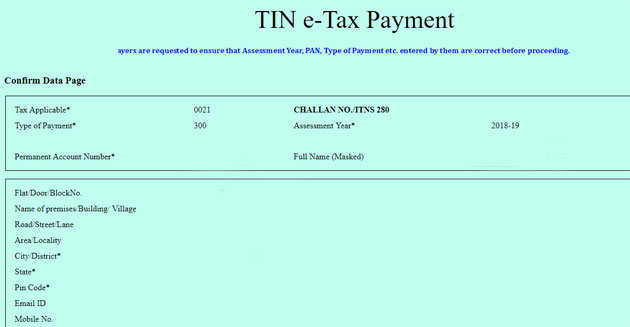

On the page select 0021 income tax other than companies. Itns 280 itns 281 itns 282 itns 283 itns 284 or form 26 qb demand payment. Select the relevant challan i e. Enter pan tan as.

If you do not have net banking account then you can use your friend s relative s or any other individual s bank account for payment of your tax. You will be redirected to a different page. Visit the official government income tax e filing website and log in. Even tax on regular assessment surtax and tax on distributed profits of domestic companies and tax on distributed income can be paid online.

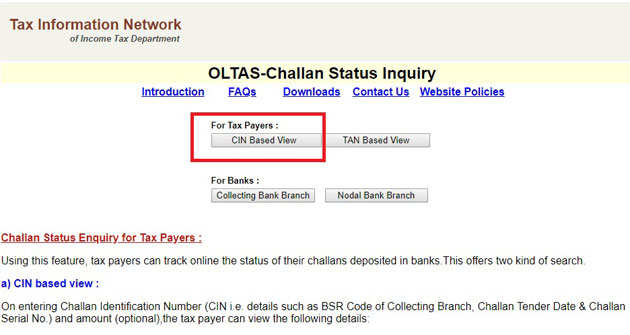

In order to further proceed with the payment of income tax online the taxpayer will have to login to the net banking site with user id password provided by the bank for net banking purpose and enter the payment details on the bank site. Steps for income tax online payment in india step 1. Enter other details such as. After the payment is successful through internet banking website download the income tax challan tax paid counterfoil receipt to produce to it dept while filing the income tax returns.

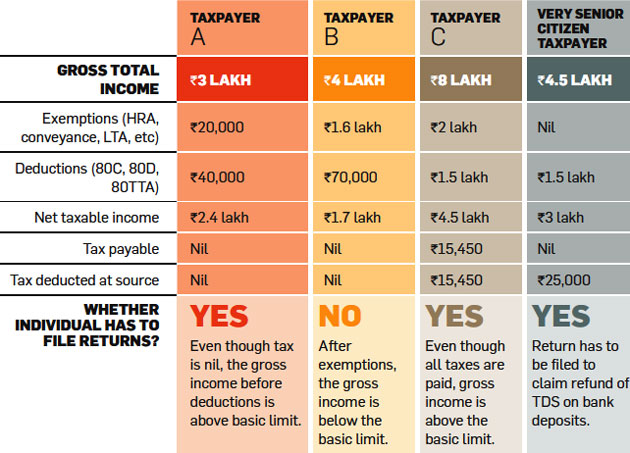

Taxes that can be paid online by individuals are advance tax and self assessment tax. Documents and information required.