How To Pay Advance Income Tax Online Through Icici Bank

It can be deposited in authorised banks such as icici bank reserve bank of india hdfc bank syndicate bank allahabad bank state bank of india and more.

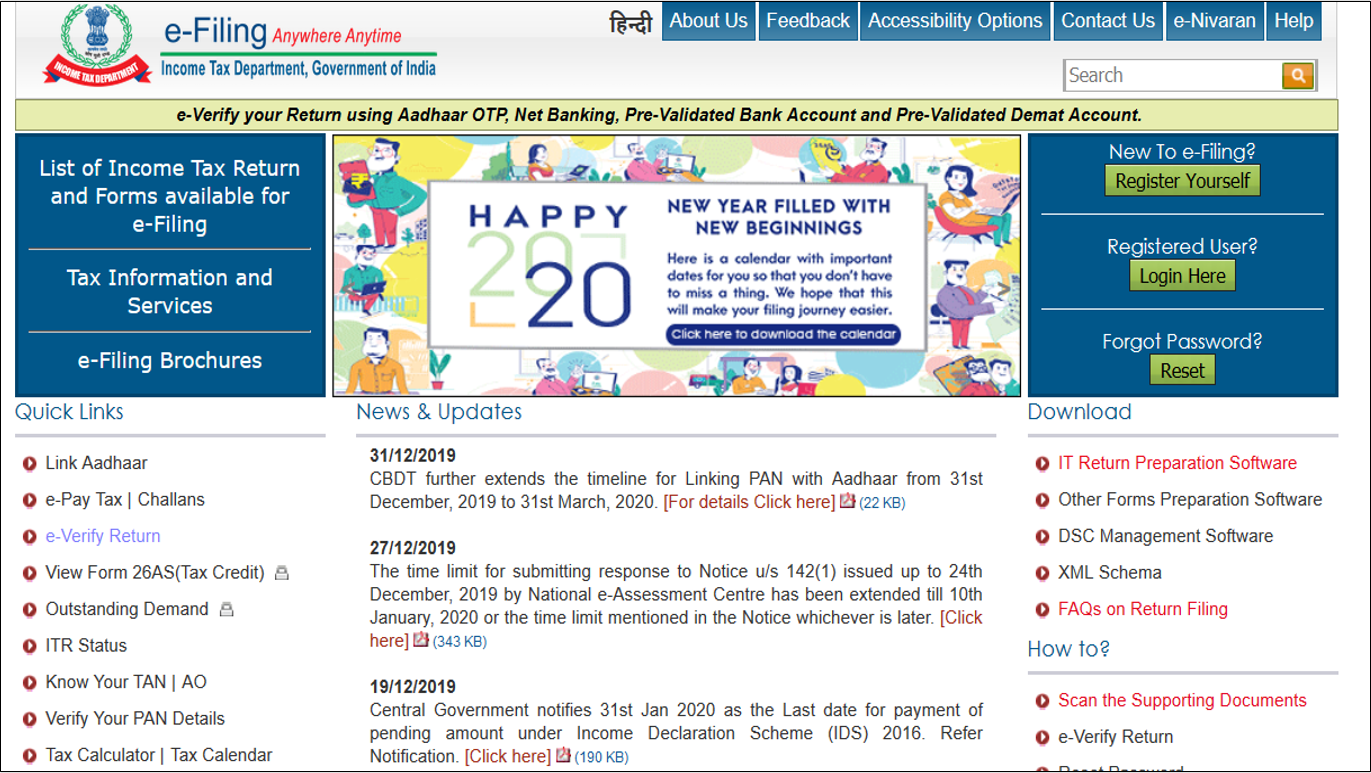

How to pay advance income tax online through icici bank. On the other hand if you are paying self assessment taxes to be paid before filing itr select the current financial year as assessment year and code 300 self assessment tax. If 90 of the tax due is not paid by the financial year end interest 1 is charged. Code 400 tax on regular assessment is paid when you are paying tax following a notice received by you from the income tax department. Pay taxes through online tax include corporation tax service tax tax deducted at source income tax wealth tax and central excise.

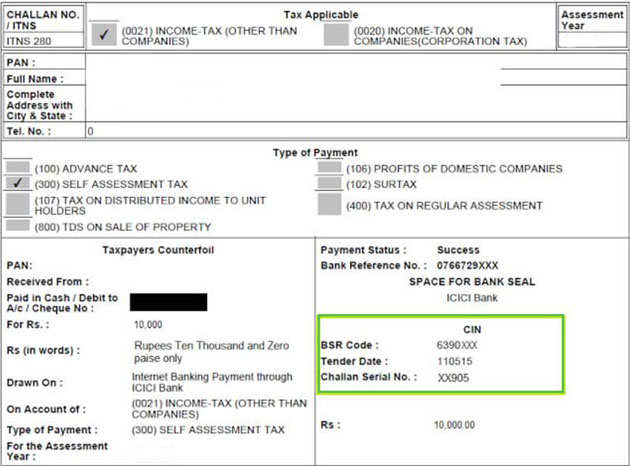

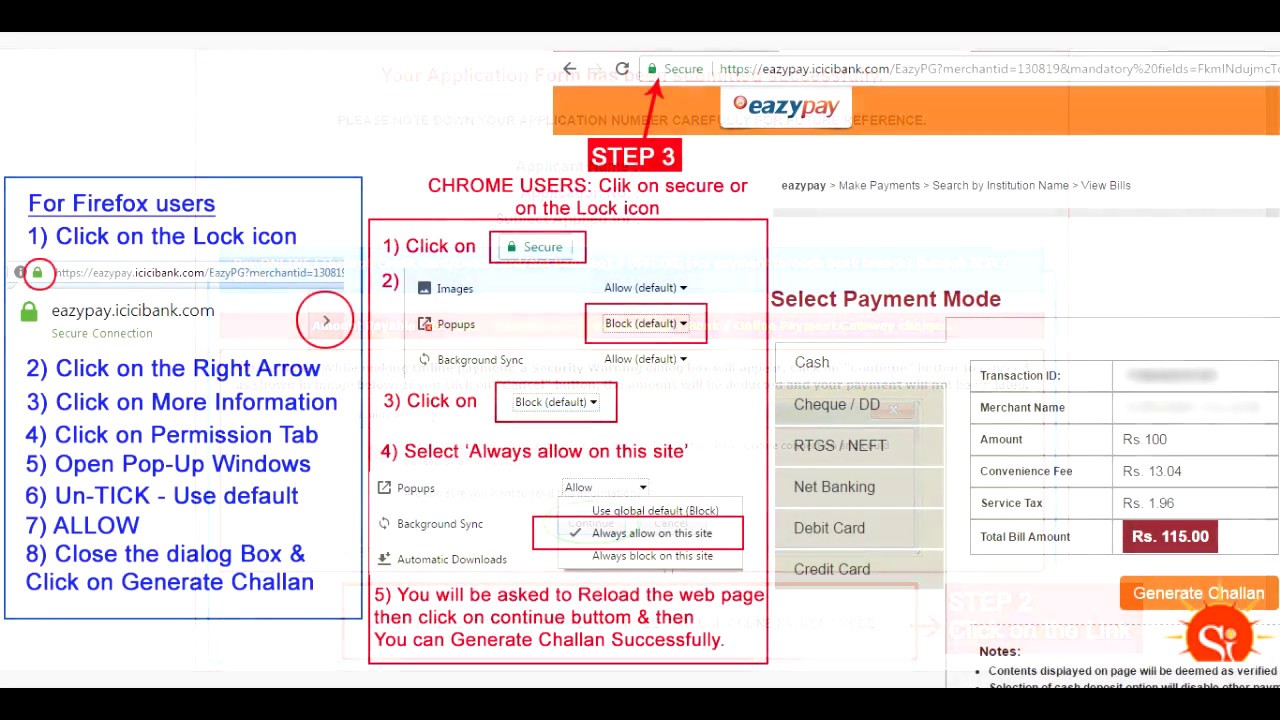

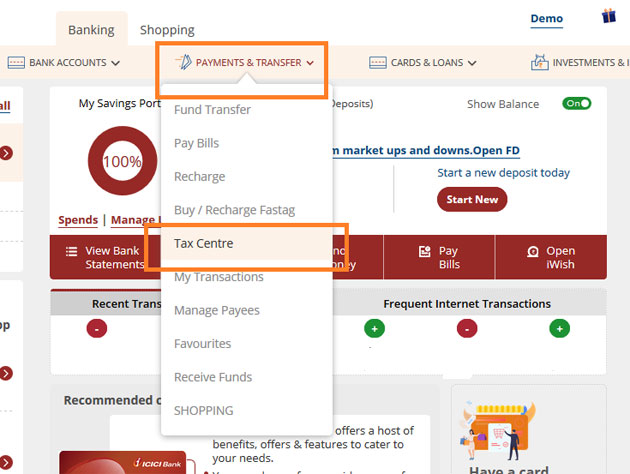

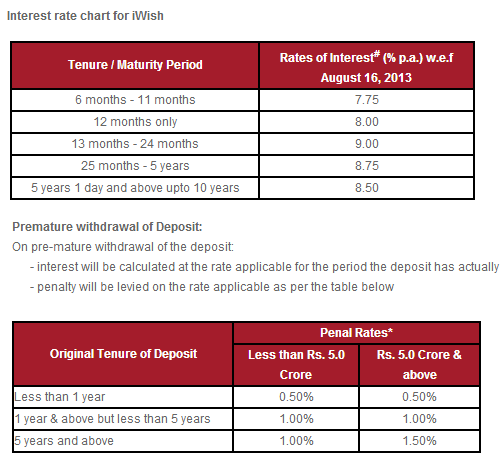

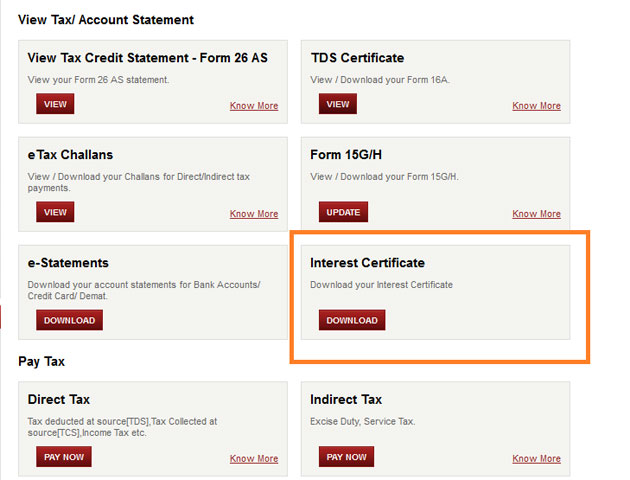

Icici bank internet banking presents a simple and secure method for filing your taxes online. File your tax in 4 simple steps login to your internet banking with user id and password to get your user id click here. At the time of making an advance tax payment select next financial year because that will be the assessment year and code 100 advance tax. Advance tax using challan 280 online icici bank 1 2 check the details already pre filled as in the form 3 fill the details of the tax to be paid income tax the amount of tax due excluding education cess.

Penalty is imposed for non payment of advance tax on the scheduled time mentioned above. Cut down on your paper work and simplify the process get an mis link that shows you a record of all past payments made along with the payment status as well as challan details. Section 234b of income tax act interest for non payment of advance tax. Taxpayer to enter payment details and authorize the payment.

Percentage of advance tax. The taxpayer will login to the icici bank internet banking site with the user id password provided by the icici bank retail internet banking. How do i re print tax payment challan pay by icici e banking. Tax payments icici bank with its technology driven banking gives you a better option online tax.

This penalty is paid along with the taxes due before income tax return filing. Advance tax payment.