How Much Salary Need To Pay Income Tax In Malaysia 2019

Epf tax relief limit revised to rm4000 per year.

How much salary need to pay income tax in malaysia 2019. The most important part of income tax is knowing how much you owe the inland revenue board. Your average tax rate is 15 12 and your marginal tax rate is 22 50. Employee epf contribution has been adjusted to follow epf third schedule. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6.

If you are earning on average less then 2 500 a month you re not required to file taxes. How does monthly tax deduction mtd pcb work in malaysia. What is tax rebate. Employee epf contribution has been adjusted to follow epf third schedule.

Especially as new reliefs are included while old ones get removed every year. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. This marginal tax rate means that your immediate additional income will be taxed at this rate. In 2009 malaysia s income tax moved to a monthly tax deduction mtd or potongan jadual bercukai pcb.

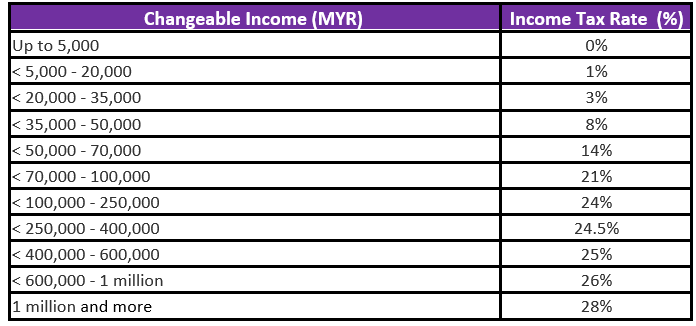

Epf tax relief limit revised to rm4000 per year. Removed ya2017 tax comparison. For example let s say your annual taxable income is rm48 000. Here are the income tax rates for personal income tax in malaysia for ya 2019.

Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. What is income tax return. That means that your net pay will be rm 59 418 per year or rm 4 952 per month. Removed ya2017 tax comparison.

Income tax facts in malaysia you should know. How to pay income. Updated pcb calculator for ya2019. If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582.

Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epfdeductions has to register a tax file. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8. Introduced pcb schedule mode where pcb amount will match lhdn pcb schedule.

Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. Updated pcb calculator for ya2019. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others.